Canada’s “Bubbly” Housing Market Could Be Risky for Homebuyers

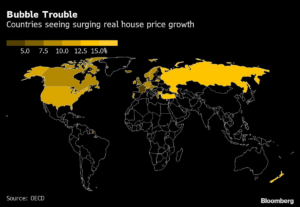

Canada’s real-estate market has entered a bubble with two new reports, reinforcing fears among housing experts who believe that the housing market is becoming further detached from the fundamentals. Bloomberg, the global news and data firm, generated a “Bubble Ranking”, consisting of country scores based on home buying and real-estate factors: costs of buying a home compared to renting, the price-to-income ratio, inflation-adjusted price growth, nominal price growth, and the annual rate of household credit growth. Bloomberg ranked Canada as second bubbliest housing market on the planet, with Sweden, Norway, and United Kingdom tailing behind and New Zealand taking first place.

“A cocktail of ingredients is sending house prices to unprecedented levels worldwide,” Bloomberg economist Niraj Shah reports. “Record low interest rates, unparalleled fiscal stimulus, lockdown savings ready to be used as deposits, limited housing stock, and expectations of a robust recovery in the global economy are all contributing.”

Source: OECD, Bloomberg

Source: OECD, Bloomberg

READ THE FULL RANKING ON BLOOMBERG

To learn more about WiiBid’s innovative digital mortgage marketplace, visit www.wiibid.com Follow @wiibidcanada for deals and promotions to save even more on your mortgage throughPosted on by Sharlyn Monillas

TaggedBC, blog, bubbly, canada, Canadian mortgage, homebuyers, homebuying, housing market, interest rates, news, Real Estate, risk